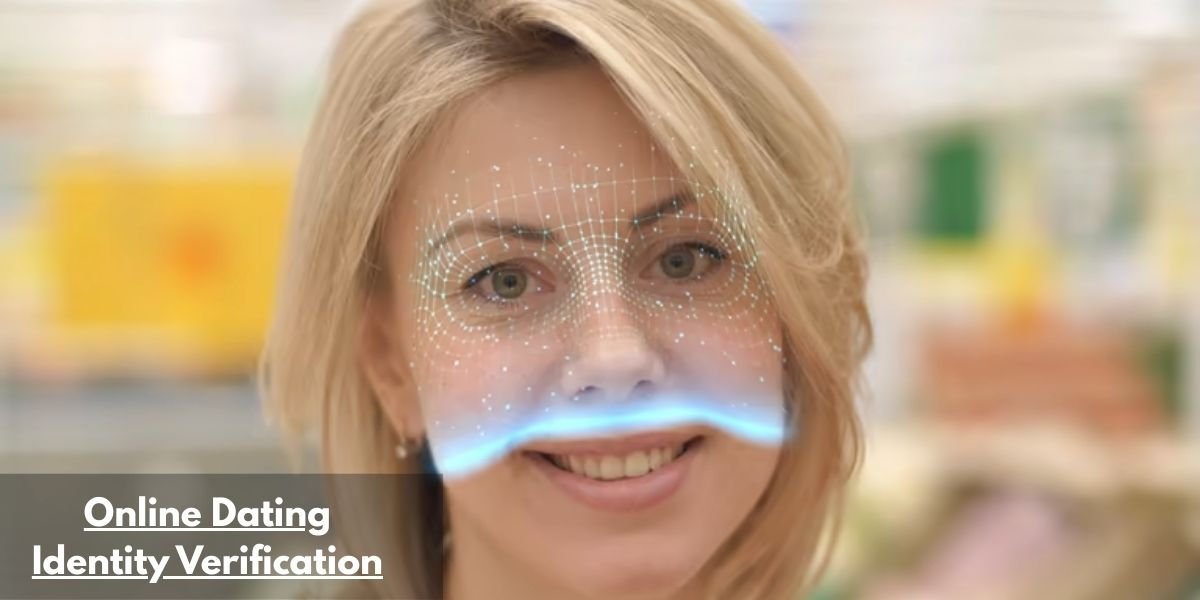

Online Dating Identity Verification: How to Stay Safe While Finding Love

The world of online dating has transformed how we find love, offering endless possibilities right at our fingertips. Yet, with millions of profiles comes a

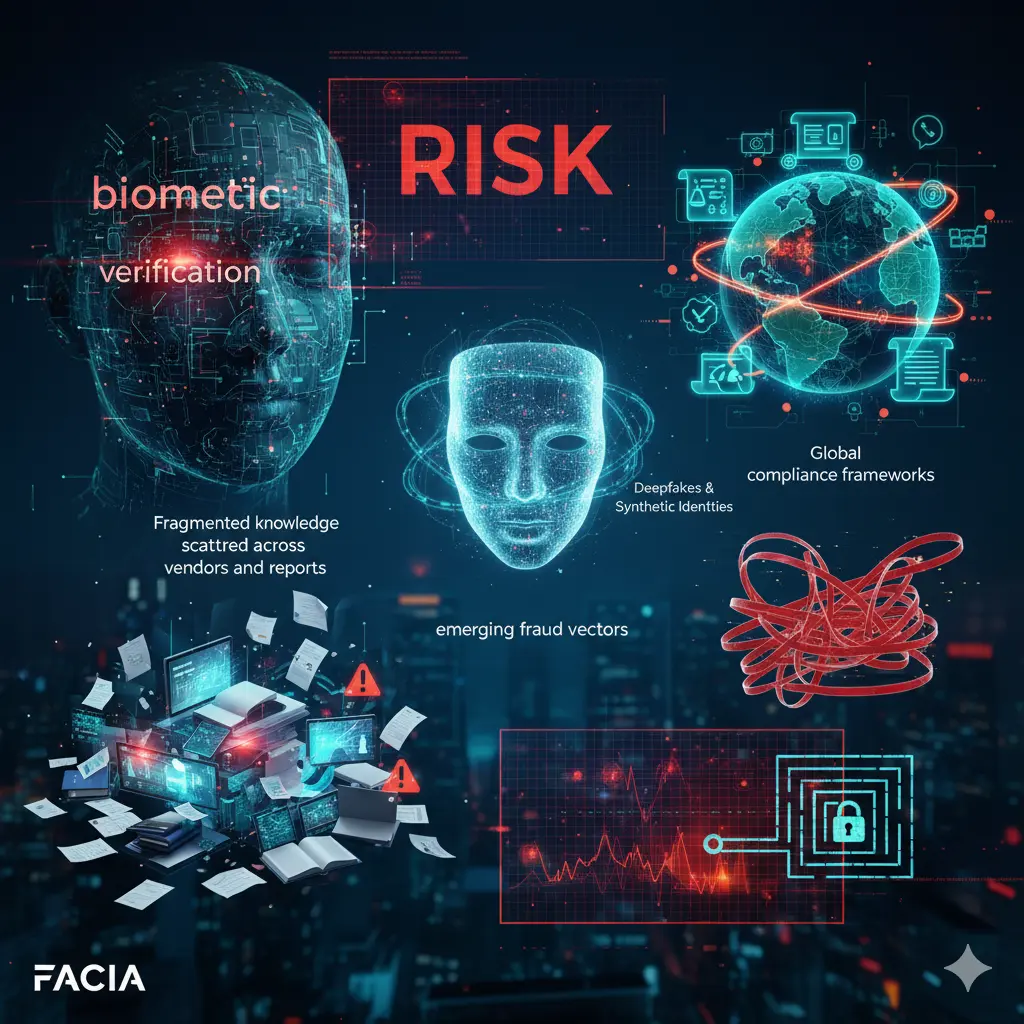

In an era where digital trust defines business success, biometric verification stands at the frontlines of fraud prevention. Facia is your go-to intelligence hub for in-depth analysis, cutting-edge research, and real-world updates in facial recognition, liveness detection, deepfake prevention, and compliance frameworks.

We don’t sell verification software, but we empower industries, enterprises, and policymakers with clear, credible, and timely information to make smarter security decisions.

Facia began its journey working closely with businesses and organizations implementing biometric verification systems. We saw the same pattern over and over again: companies investing in advanced technologies without a clear understanding of risks, capabilities, and compliance requirements.

From financial institutions struggling with onboarding fraud to healthcare providers facing strict data regulations, the challenges were clear:

So, Facia evolved from a hands-on biometric solutions partner into a specialized intelligence hub, dedicated to delivering up-to-the-minute news, technical guides, case studies, and analysis. Today, our platform connects security leaders, compliance officers, and tech innovators with the knowledge they need to protect identities in an increasingly complex digital world.

We are a collective of biometric analysts, AI researchers, fraud investigators, and compliance experts, each bringing a unique perspective to the identity security conversation.

Over 5+ years of experience in identity verification, specializing in facial recognition system performance evaluation.

Expert in deep learning models for facial recognition and anti-spoofing techniques.

Former financial investigator focusing on digital onboarding fraud.

Keeps a pulse on GDPR, CCPA, and global biometric compliance laws.

Together, our mission is to transform fragmented security knowledge into a central, trusted resource.

To build the world’s most comprehensive knowledge platform for biometric identity verification, ensuring that decision-makers everywhere have access to unbiased, evidence-based, and actionable insights.

Timely coverage of fraud incidents, security breaches, and biometric advancements so you can stay ahead of evolving threats.

Detailed explorations into how facial recognition, liveness detection, and deepfake prevention work, including performance benchmarks, bias mitigation, and architecture designs.

A clear view of global laws, data privacy requirements, and industry standards that affect biometric verification deployments.

Forward-looking insights into AI models, camera hardware, cloud deployments, and ethical considerations in biometric security.

Security is no longer a defensive measure; it’s a competitive advantage. Organizations that deploy intelligent, privacy-first identity verification systems are positioned to earn trust, meet compliance, and operate at scale without compromise.

No vendor bias. Every insight is drawn from industry-wide research and vetted by security professionals.

We track developments from Asia-Pacific to North America, offering a truly global view.

Our reports go beyond theory, offering practical takeaways for implementation and risk mitigation.

The world of online dating has transformed how we find love, offering endless possibilities right at our fingertips. Yet, with millions of profiles comes a

Imagine a busy Saturday night. Your bar is packed, the music is loud, and the line at the door is growing. Your bouncer is moving

Facial Recognition Technology (FRT) is a type of biometric software that identifies or verifies a person from a digital image or a video frame by

Biometric verification is evolving with technologies and developments in the world of AI. We have progressed significantly from basic fingerprint scanning to facial verification. Now,

Since 1918, Automated Teller Machines (ATMs) have gained massive popularity and spread worldwide, providing smooth and effortless banking. They save consumers time since they don’t

With the increasing use of digital devices, cyber crimes are also rising rapidly. AI-powered technology has made it even easier for criminals to commit fraud

Whether you’re a security leader, compliance officer, developer, or simply curious about biometric verification, Facia gives you the clarity you need in a fast-moving industry.